I am no investment guru but do know that I need to save money for the future. Yet, saving itself is not enough because thanks to inflation, money kept in your bank account is losing its value fast! We need to invest to help make our money work as hard as we do. What's more, most major banks in the US do not give any tangible interest on savings/checking account.

If you are in the USA, either as a citizen, permanent resident, green card or even on a visa such as H1B or L1 then you should invest without a doubt. You may choose not to invest in the USA if you plan to leave the US after a year or two for good, in which case I would assume you are investing in your primary/target home country. The question is where to invest today in the US. Time is money, literally and hence you need to act fast and make your hard earned money last longer. As I mentioned above, saving is not enough as money in your checking/savings account is actually getting depleted. You need to invest, by starting with simple ways, on a recurring frequency.

I would begin with a disclaimer that I am by no means a financial, tax or a legal expert. I am sharing my learnings with the hope that it would help someone think further on this topic and tweak it as per his/her unique financial situation.

There are multiple avenues for investment in the US. You could dabble in stocks if that is your inclination, but I am no expert in picking stocks. It seems too much of a hassle to me, and I do believe that timing the market is not possible. Hence a handful of gain here and there, would not be worth the hundreds of hours of sitting and monitoring your stock portfolio. You could invest in Mutual Funds, but I found that the Mutual Fund system in the US does not provide facts and figures freely, and entry is expensive. Websites such as Morningstar are awesome, but the real numbers and analysis are all subscription based.

The title of this post says the top two places to invest. Remember that investing is different from saving, and before you move to invest, you should always save approximately 4 to 6 months worth of expenses in a savings account or other reliable liquid asset class. This would be your emergency fund which you should never touch. Oh and, buying that new 60 inches curved LCD does not classify as an emergency. Not being able to pay your rent due to job loss, is an emergency.

Assuming you have set aside an emergency fund, then shown below is one of possible investment split. Let's say you are making $80,000 per year, with $6000 in monthly expenses. Your emergency fund should have about $30,000. This is not a hard rule, but you would need to tweak this based on your financial situation.

Without much ado, here are the top two places I would prefer to begin investing today:

I delayed starting my own 401K for long, convincing myself that the money would be stuck till old age. I was wrong. If your employer provides 401K with employer match, then this is a must do. The benefit here is two-fold. First, if you contribute X amount every month, then your employer will partly match by contributing an additional Y amount. This Y amount is free money! Try to contribute at least up to the limit till which you can extract the maximum allowable employer match amount. Read more on this topic here.

Secondly, this monthly contribution reduces your tax liability. So if you are making $75,000 per year, and begin contributing $500 per month to 401k, not only did you begin to create your retirement nest egg, but your yearly taxable salary comes down to $69,000 saving a bit of your taxability!

If you are not savvy about choosing specific funds or stocks for your 401K, then most firms, such as Vanguard offer age-specific funds such as Target Retirement 2045. Don't be alarmed by the word 'retirement' in this fund. It simply means that following the industry best practices, this fund will invest your money in such a way that it would begin with greater risk(and greater returns) now, but will gradually reduce risk to get a more stable money pool by the year 2045. There are multiple funds available for you to choose by which year you want to get a more certain amount. if you are young now, choose a slightly greater risk now to give a huge head start to your funds. This is great because you no longer need to remember to keep monitoring your funds on a regular basis and calculate the buy/sell ratio required to match your age and risk status.

I have read that a quick rule of thumb is to deduct your age with 110 to get the ratio of high-risk vs low-risk investment assets. So if you are 35 today, deduct by 110 to get 75. This means that normally about 75 to 80% of your money should go into equity/stocks etc., while the rest in debt.

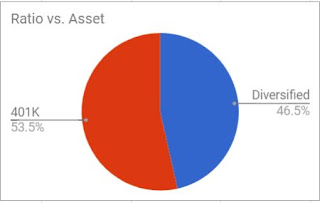

In my 401K account, I see that Vanguard automatically chose almost a similar mix as shown below.

Money should be withdrawn from 401k account preferably after age 59 1/2 for maximum benefits, which can be done even if not being in the US in case you hold a non-immigrant visa.

You can invest in stocks or mutual funds but personally, I do not enjoy spending too much time in tracking stocks, and Mutual Funds can be quite expensive. The alternative then is to look into Index funds. These are funds which are designed to match the market, and not to aim at beating it. With this goal, their fee becomes almost negligible. These funds have a very consistent performance and may give anywhere between 5-11% returns if maintained for the long run. Like any other stock related product, performance is not guaranteed.

I did my share of research on the internet and found services such as Wealthfront.com exists which apply a lot of thought, research and engineering to automatically invest our money into the various asset classes. They apply a lot of basic and advanced investment best practices into automated investment. You can specify a one-time or recurring money deposit from your bank account, and the website would automatically invest that amount into various asset classes. They will ensure that your money is not in a single fund, but well distributed to reduce risk. They also have some nice features such as tax loss harvesting etc. They also move your investment to assets based on your risk profile. In short, this is a really nice service and is meant to almost setup and forget.

Brokerage firms such as Fidelity, TradeKing(now Ally) etc. allow people to manage their stocks or mutual funds but they charge you for every sale, and you are on your own for the sell/buy decisions. So today if you have Apple stocks, but want to sell them tomorrow due to the stock not doing good, then you would need to pay a fixed percentage fee to the brokerage firm. This is not the case with Wealthfront. They do charge a yearly fixed .25% maintenance charge, but they do not charge you for any additional transaction, sells, buys. Which means that even if you have thousands of funds in your portfolio, Wealthfront can keep shuffling them around to give you the most efficient portfolio, without an additional fee. They actively keep on managing, churning your money to make it work best based on your inputs. To make it better, as of writing, they would manage money up to a total of $10,000 for free. So you may just choose to begin by putting in say $500 and see how you like it.

I like a number of features of WealthFront, for example, the way it can create a very personalized forecast of how much money you need to save to meet your retirement. This is displayed in a nice graph which you can play with to do a what-if analysis very easily.

The other feature I like is that you can create a risk profile rating based on how aggressively you wish to take a risk vs getting returns. Post that, a diversified portfolio is selected. The best part is that they show a very transparent view of what the portfolio consists of. There is even a short description of why one fund was chosen in that category.

Wealthfront creates the investment strategy based on the Modern Portfolio Theory. Read more about it here. It also takes care to automatically reinvest any dividends.

There might be better tools in future, but as of today, Wealthfront is working nicely for me giving about 11% in time-weighted returns. You might even go in a loss as market performance is not guaranteed, but if you are there for the long haul, beyond 5 years I read that the returns usually begin averaging out between 5 to 11%. Read my first post for more disclaimer and legal mumbo-jumbo!

It helps hugely if you are consistent with a recurring monthly deposit from your bank. This makes use of Dollar-Cost Averaging to make you buy more stocks when the market is low and fewer stocks when the market is high. My paycheck arrives on 1st of every month, and I have set up the service to deduct a small amount to be moved to Wealthfront on the 5th. So before you realize, your money gets invested, ready to experience the magic of compounding over years.

I did check some other rivals such as Betterment, but found that the entry cost for Wealthfront for amounts less than 2 million dollars are the least So if you are just starting out, Wealthfront might be cheaper than betterment because the initial $10,000 are always managed for free(as of writing).

Remember that you would need to pay taxes on any incurred profits, dividends etc. and that whatever solution you choose, it is always a good idea to check every now and then on how things are doing.

Also, check out the videos of Dave Ramsey and read books such as The Millionaire Next Door to get lots of good financial planning tips!

Did you consider a robo investor such as Wealthfront, or Betterment? Do comment below to share your thoughts on what you liked or disliked to help others in the same boat.

* 7/4/2018 - Updated to reflect the change in Wealthfront new account promotion.

If you are in the USA, either as a citizen, permanent resident, green card or even on a visa such as H1B or L1 then you should invest without a doubt. You may choose not to invest in the USA if you plan to leave the US after a year or two for good, in which case I would assume you are investing in your primary/target home country. The question is where to invest today in the US. Time is money, literally and hence you need to act fast and make your hard earned money last longer. As I mentioned above, saving is not enough as money in your checking/savings account is actually getting depleted. You need to invest, by starting with simple ways, on a recurring frequency.

I would begin with a disclaimer that I am by no means a financial, tax or a legal expert. I am sharing my learnings with the hope that it would help someone think further on this topic and tweak it as per his/her unique financial situation.

There are multiple avenues for investment in the US. You could dabble in stocks if that is your inclination, but I am no expert in picking stocks. It seems too much of a hassle to me, and I do believe that timing the market is not possible. Hence a handful of gain here and there, would not be worth the hundreds of hours of sitting and monitoring your stock portfolio. You could invest in Mutual Funds, but I found that the Mutual Fund system in the US does not provide facts and figures freely, and entry is expensive. Websites such as Morningstar are awesome, but the real numbers and analysis are all subscription based.

The title of this post says the top two places to invest. Remember that investing is different from saving, and before you move to invest, you should always save approximately 4 to 6 months worth of expenses in a savings account or other reliable liquid asset class. This would be your emergency fund which you should never touch. Oh and, buying that new 60 inches curved LCD does not classify as an emergency. Not being able to pay your rent due to job loss, is an emergency.

Assuming you have set aside an emergency fund, then shown below is one of possible investment split. Let's say you are making $80,000 per year, with $6000 in monthly expenses. Your emergency fund should have about $30,000. This is not a hard rule, but you would need to tweak this based on your financial situation.

|

| One possible investment portfolio split |

Without much ado, here are the top two places I would prefer to begin investing today:

Baby steps, but steady steps with 401k

I delayed starting my own 401K for long, convincing myself that the money would be stuck till old age. I was wrong. If your employer provides 401K with employer match, then this is a must do. The benefit here is two-fold. First, if you contribute X amount every month, then your employer will partly match by contributing an additional Y amount. This Y amount is free money! Try to contribute at least up to the limit till which you can extract the maximum allowable employer match amount. Read more on this topic here.

Secondly, this monthly contribution reduces your tax liability. So if you are making $75,000 per year, and begin contributing $500 per month to 401k, not only did you begin to create your retirement nest egg, but your yearly taxable salary comes down to $69,000 saving a bit of your taxability!

If you are not savvy about choosing specific funds or stocks for your 401K, then most firms, such as Vanguard offer age-specific funds such as Target Retirement 2045. Don't be alarmed by the word 'retirement' in this fund. It simply means that following the industry best practices, this fund will invest your money in such a way that it would begin with greater risk(and greater returns) now, but will gradually reduce risk to get a more stable money pool by the year 2045. There are multiple funds available for you to choose by which year you want to get a more certain amount. if you are young now, choose a slightly greater risk now to give a huge head start to your funds. This is great because you no longer need to remember to keep monitoring your funds on a regular basis and calculate the buy/sell ratio required to match your age and risk status.

I have read that a quick rule of thumb is to deduct your age with 110 to get the ratio of high-risk vs low-risk investment assets. So if you are 35 today, deduct by 110 to get 75. This means that normally about 75 to 80% of your money should go into equity/stocks etc., while the rest in debt.

In my 401K account, I see that Vanguard automatically chose almost a similar mix as shown below.

Money should be withdrawn from 401k account preferably after age 59 1/2 for maximum benefits, which can be done even if not being in the US in case you hold a non-immigrant visa.

Make your money work hard with automatic investments at WealthFront

You can invest in stocks or mutual funds but personally, I do not enjoy spending too much time in tracking stocks, and Mutual Funds can be quite expensive. The alternative then is to look into Index funds. These are funds which are designed to match the market, and not to aim at beating it. With this goal, their fee becomes almost negligible. These funds have a very consistent performance and may give anywhere between 5-11% returns if maintained for the long run. Like any other stock related product, performance is not guaranteed.

I did my share of research on the internet and found services such as Wealthfront.com exists which apply a lot of thought, research and engineering to automatically invest our money into the various asset classes. They apply a lot of basic and advanced investment best practices into automated investment. You can specify a one-time or recurring money deposit from your bank account, and the website would automatically invest that amount into various asset classes. They will ensure that your money is not in a single fund, but well distributed to reduce risk. They also have some nice features such as tax loss harvesting etc. They also move your investment to assets based on your risk profile. In short, this is a really nice service and is meant to almost setup and forget.

Brokerage firms such as Fidelity, TradeKing(now Ally) etc. allow people to manage their stocks or mutual funds but they charge you for every sale, and you are on your own for the sell/buy decisions. So today if you have Apple stocks, but want to sell them tomorrow due to the stock not doing good, then you would need to pay a fixed percentage fee to the brokerage firm. This is not the case with Wealthfront. They do charge a yearly fixed .25% maintenance charge, but they do not charge you for any additional transaction, sells, buys. Which means that even if you have thousands of funds in your portfolio, Wealthfront can keep shuffling them around to give you the most efficient portfolio, without an additional fee. They actively keep on managing, churning your money to make it work best based on your inputs. To make it better, as of writing, they would manage money up to a total of $10,000 for free. So you may just choose to begin by putting in say $500 and see how you like it.

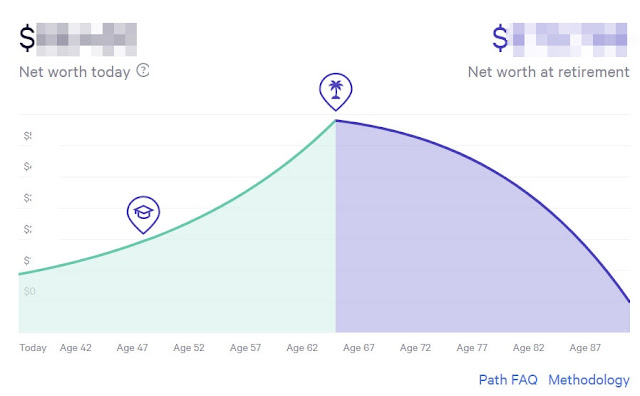

I like a number of features of WealthFront, for example, the way it can create a very personalized forecast of how much money you need to save to meet your retirement. This is displayed in a nice graph which you can play with to do a what-if analysis very easily.

|

| Wealthfront shows a visual graph of how long will your current savings last |

The other feature I like is that you can create a risk profile rating based on how aggressively you wish to take a risk vs getting returns. Post that, a diversified portfolio is selected. The best part is that they show a very transparent view of what the portfolio consists of. There is even a short description of why one fund was chosen in that category.

|

| Diversification across various asset classes, but based on your risk appetite |

Wealthfront creates the investment strategy based on the Modern Portfolio Theory. Read more about it here. It also takes care to automatically reinvest any dividends.

There might be better tools in future, but as of today, Wealthfront is working nicely for me giving about 11% in time-weighted returns. You might even go in a loss as market performance is not guaranteed, but if you are there for the long haul, beyond 5 years I read that the returns usually begin averaging out between 5 to 11%. Read my first post for more disclaimer and legal mumbo-jumbo!

|

| Wealthfront displaying my Time-Weighted Returns so far |

It helps hugely if you are consistent with a recurring monthly deposit from your bank. This makes use of Dollar-Cost Averaging to make you buy more stocks when the market is low and fewer stocks when the market is high. My paycheck arrives on 1st of every month, and I have set up the service to deduct a small amount to be moved to Wealthfront on the 5th. So before you realize, your money gets invested, ready to experience the magic of compounding over years.

I did check some other rivals such as Betterment, but found that the entry cost for Wealthfront for amounts less than 2 million dollars are the least So if you are just starting out, Wealthfront might be cheaper than betterment because the initial $10,000 are always managed for free(as of writing).

How to get $5000 managed for free in WealthFront!

If you register through my referral link here, then you and I both would get an additional $5000 managed for free! You can start with a one-time payment as low as $500 and see if you like it.Remember that you would need to pay taxes on any incurred profits, dividends etc. and that whatever solution you choose, it is always a good idea to check every now and then on how things are doing.

Also, check out the videos of Dave Ramsey and read books such as The Millionaire Next Door to get lots of good financial planning tips!

Did you consider a robo investor such as Wealthfront, or Betterment? Do comment below to share your thoughts on what you liked or disliked to help others in the same boat.

* 7/4/2018 - Updated to reflect the change in Wealthfront new account promotion.

Comments

Post a Comment